how to lower property taxes in nj

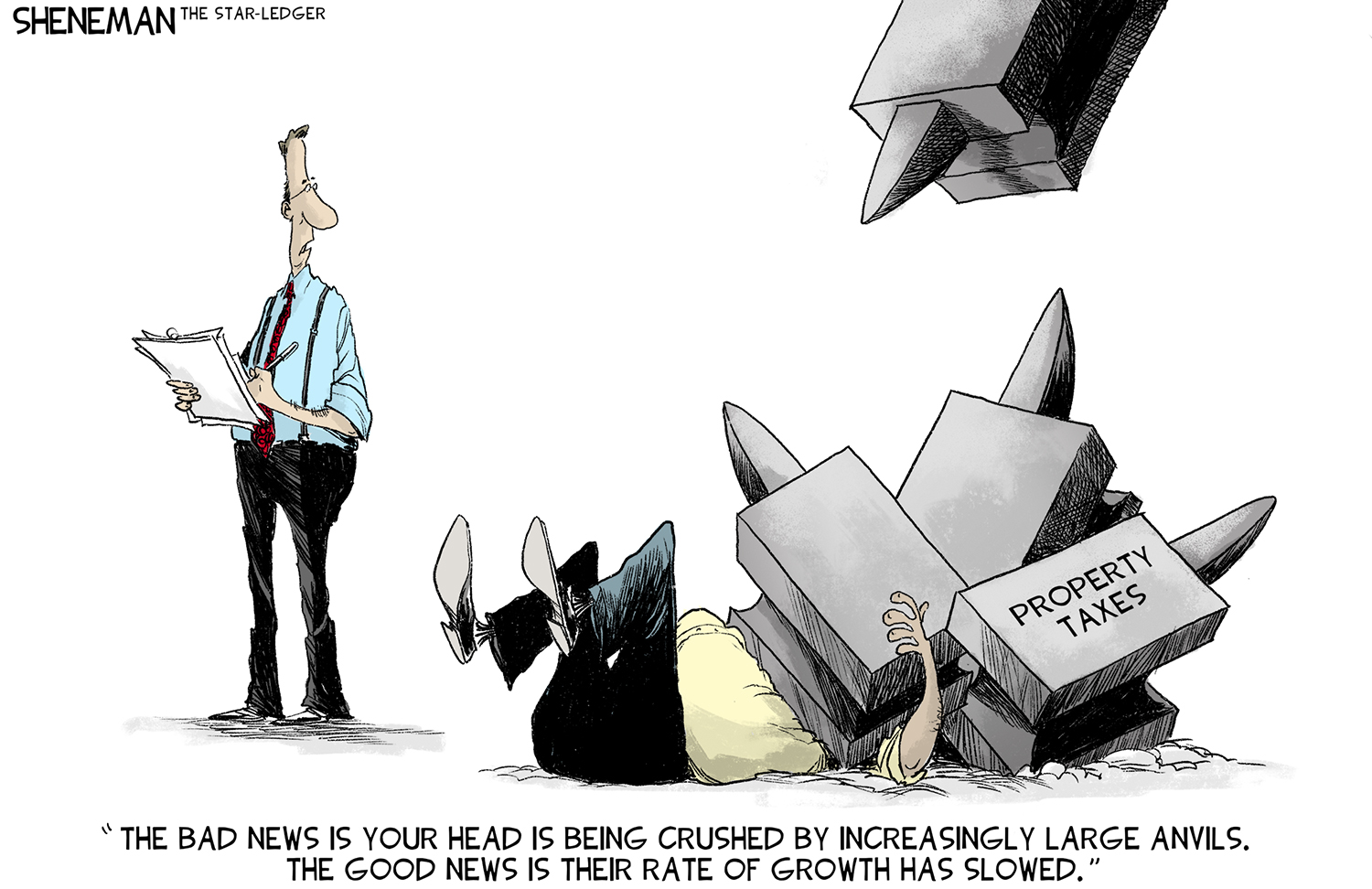

Property taxes are calculated based on assessments so when the Bamboozled home was hit with a nearly 60000 increase in in just one year it was time to fight. The irony was not lost on many people when Governor Phil Murphy bragged during his recent State of the State.

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

Murphys unveiling of a new strategy to address rising property taxes comes in the wake of another year-over-year increase in the size of the average property-tax bill.

. After some research the couple concludes that based on recent sales of comparable homes the taxable value of their home should be 350000. Mortgage Relief Program is Giving 3708 Back to Homeowners. Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law.

NJ Property Tax ReliefA Relief for Your Wallet. Be a legal resident of New Jersey for at least one year prior to October 1. Call NJPIES Call Center.

The update to the Homestead Benefit program is estimated to be worth 130 for seniors and disabled homeowners and 145 for lower-income homeowners. Keep in mind that the amount of property taxes paid that you can deduct. 250 veteran property tax deduction.

Up to 25 cash back The tax assessor has given it a taxable value of 400000. Check Your Eligibility Today. For tenants 18 of rent paid during the year is considered property taxes paid.

Active military service property tax. You must be age 65 or older or disabled with a Physicians Certificate or Social Security document as of December 31 of the pretax year. Here are five interventions to cut spending and reduce property taxes.

For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. Here are the programs that can help you lower property taxes in NJ.

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. Tax amount varies by county. Find the three tax ratios for your city.

Click on your county. Property tax relief comes in different shapes and forms in New Jerseyit can be a tax freeze a deduction or a benefit programNJ also provides various property tax exemptions you can apply for to lower your taxes. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

100 disabled veteran property tax exemption. Stay up to date on vaccine information. Check Your Tax Bill For Inaccuracies.

You can deduct your property taxes paid or 15000 whichever is less. Call the Senior Freeze Information Line at 1-800-882-6597 for more information. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Filing the appeal. For Tax Years 2017 and earlier the maximum deduction was 10000. To qualify you must.

The increase more than 170 pushed the average property-tax bill levied in New Jersey last year up to 9284 according to data from the Department of Community Affairs. The measure would change the deduction for rent payments considered as property taxes from 18 to 30. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

The deductible would increase from about 3240 to 5400 for the average. The property tax deduction reduces your taxable income. This makes their annual property tax 4000.

COVID-19 is still active. By GSI Staff. New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments.

Ad 2022 Latest Homeowners Relief Program. Checking out the tax bill itself can be an easy way to lower your property taxes. The local tax rate is 10 for every 1000 of taxable value.

With that in hand check out the details of your tax bill. Check If You Qualify For 3708 StimuIus Check. Go to the New Jersey Division of Taxation website through the link in the References section.

Chances are the city has already sent you a property assessment letter before the. New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to. You can likely obtain a free copy of your property tax bill from the local government offices.

Check Your Eligibility Today. New Jersey has one of the highest average property tax rates. Eligibility Requirements and Income Guidelines.

The average property tax bill in the country depending on whether you add in taxes such as the vehicle property tax which 27 states charge including Rhode Island 1133 per. Its important you proactively find out what the citycounty is assessing your property for first before you prepare for battle. NJ Division of Taxation - Local Property Tax Relief Programs.

189 of home value. This article will go over all NJ property tax relief programs and recommend a personalized guide to help you keep your NJ. If these three ratios are not between 0 and 1 then divide them by 100.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Own and occupy your home as of October 1 of the pretax year. The estimated cost to the state is nearly 80.

It allowed us to create a login and enter the evidence including. The house was assessed at higher amounts than more-updated neighbors. Give power back to the people of New Jersey.

1 Google assessors office.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Pin On Real Estate Investing Tips

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

How School Funding S Reliance On Property Taxes Fails Children Npr

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State Embrace Higher Property Taxes

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Tax How To Calculate Local Considerations

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Nj Property Tax Relief Program Updates Access Wealth

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

Property Taxes In Nevada Guinn Center For Policy Priorities

Nutley Real Estate Homes For Sale Information About Nutley Nj Real Estate Real Estate Tips Real Estate Nj

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How Is Tax Liability Calculated Common Tax Questions Answered

Property Taxes By State County Lowest Property Taxes In The Us Mapped